YOUR COMPETITIVE ADVANTAGE.

Aareal Bank Group

The changing face of the

property industry

While nobody knows where the journey is headed, one thing is clear: things are changing in the property industry. The continuously growing importance of sustainability, demographic trends as well as urbanisation, individualisation and other megatrends require new concepts and ideas for the way we want to live and work tomorrow. The market needs properties suited to the sort of future in which people across the globe can, and indeed want to, live in the long term.

These developments have heralded the start of a process of profound transformation within the industry, evidenced by trends towards revamped urban planning, new concepts for property use, an increasing number of green properties and the more widespread use of smart technology. At the same time, the priorities and needs of property users, operators and owners alike are changing, too.

This process of transformation also has implications for property financing and the need for digital solutions. As a partner of – and a pioneer within – the property industry, Aareal Bank Group is thus also adapting to these far-reaching changes. Our aim is to provide our clients with future-oriented products and services that tap into competitive advantages, help to facilitate long-term business success and help clients achieve their sustainability targets.

Download the charts here in PDF format.

A broad range of services

We provide players in the property sector and related industries, such as the housing and energy industries, with a wide range of advice and support services. These include:

- financing solutions for commercial properties;

- banking services and digital solutions to drive process optimisation;

- offering ERP software and digital solutions for the European property industry and its partners.

Our ambition is to demonstrate that we are a leading international provider of smart financing, software products, digital solutions and payment transaction applications in the property sector and related industries. We do business, act and make decisions sustainably – out of conviction.

Aareal Next Level: enhancing growth

The process of transformation within the property industry opens up a whole host of potential for us to continue on, and forge further ahead with, our successful growth trajectory in each and every one of our business segments. We have defined exactly how we intend to seize these opportunities and what objectives we have set as part of our strategy in our “Aareal Next Level” concept.

The core element of this strategy is our objective of achieving consolidated operating profit of around €300 million in 2023. We are aiming for another marked increase to up to €350 million in 2024. This is, of course, subject to the assumption that the pandemic will have been fully overcome by then, and that the risk situation will have returned to normal.

We are keeping a close eye on the demands placed upon us by relevant stakeholders, as well as on the impact of our actions in both the short and long term. Bearing in mind the social, ecological and governance aspects of business decisions allows us to add value sustainably – for all our stakeholders.

René Steurer

Group Managing Director Corporate Strategy

„Aareal Next Level“ is bearing fruit: we achieved a significant turnaround in the financial year under review, further strengthening our starting position for sustainable growth. We want to use this as a basis for dynamic growth over the coming years, not only within Aareon, but also in the banking business.“

Our strategy is guided by the “Aareal Next Level” concept.

In our quest to achieve these goals, we are focusing on tapping into new growth opportunities and on an expanded range of strategic options. Moreover, we will optimise our funding mix and capital structure, implementing a range of measures to make us more efficient. Our aim is to achieve a cost/income ratio of below 40 per cent in the Bank’s financing business by 2023. Aareal Bank will leverage its solid capital position to finance growth and investments for the future – whereby a change in the balance between distributions and investments will be examined within the framework of its existing dividend policy.

Our three business segments are subject to different overall conditions, meaning that their growth potential varies, too. As a result, they are pursuing different goals and have different focal points within the context of our Group strategy.

- Structured Property Financing: from ACTIVATE! to GROW!

Our aim is to increase our portfolio volume by €1 billion a year to arrive at a figure of around €33 billion by the end of 2024. We are seeking to grow in our core sectors and regions in particular. We will also be looking at opportunities to expand into new areas where our expertise can be deployed. - Banking & Digital Solutions: from ELEVATE! to LEVERAGE!

We are aiming to achieve growth in net commission income averaging around 13 per cent a year between now and 2023. We want to achieve this mainly by expanding our product range, in particular in the digital arena, and through further strategic partnerships.We are aiming to keep deposit volumes – which are important for our funding – stable at the current level of more than €12 billion up to 2024. - Aareon: continue to ACCELERATE!

Aareon is to become a “Rule of 40” SaaS company by 2025, with Aareon’s combined EBITDA margin and revenue growth rate to exceed 40 per cent in the long run. At the same time, adjusted EBITDA is to increase to around €155 million, including earnings of around €20 million contributed by the acquisitions already completed to date. This does not yet include the positive effects of possible further acquisitions over the coming years. In order to achieve this objective, we will continue to grow organically with our ERP systems and digital solutions, while also implementing the Value Creation Programme and expanding the software-as-a-service business. We will be further accelerating Aareon's inorganic growth at the same time by making targeted acquisitions.

Download the charts here in PDF format.

Sustainability: a key component of our development

Doing business sustainably is a top strategic priority for us. We want to use the way we think, act and make decisions to promote sustainable development and create long-term value while taking ESG risks into account. We are guided in these efforts by both the international climate protection targets of the Paris Climate Agreement and the United Nations' Sustainable Development Goals.

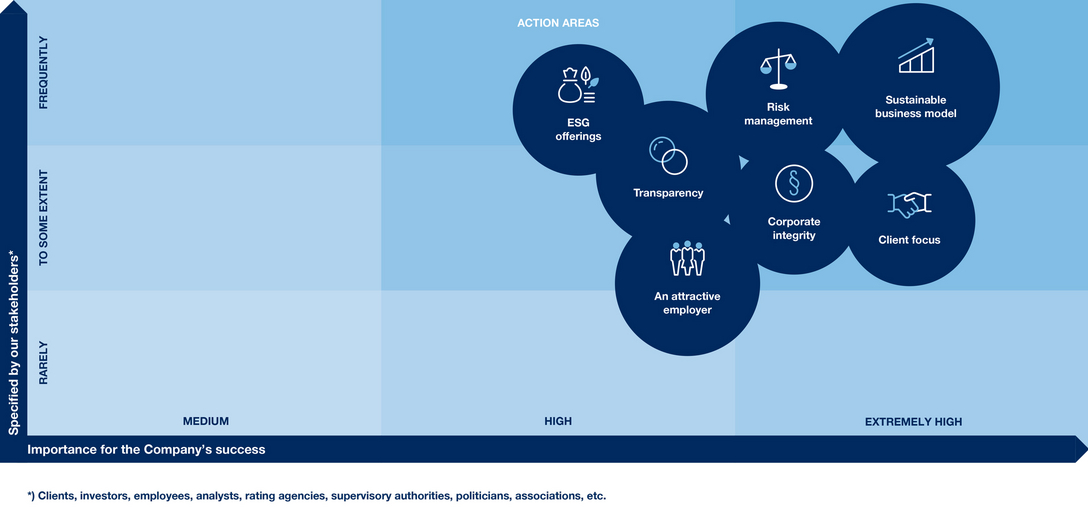

Aareal Bank Group's materiality matrix. Download the charts here in PDF format.

We are involved in a process of ongoing dialogue with our stakeholders on ESG issues and once again made sure they were closely involved in the further development of our materiality analysis over the past financial year. This process left no doubt as to one thing: ESG remains an issue that is increasingly important for almost all of our business segments. The topics of corporate integrity and transparency, in particular, have become even more relevant. The analysis also confirmed the considerable importance attached to the topics of “client focus” and “attractive employer”. The overall area of ESG offerings – in other words, which products and services from our three business segments contribute to the sustainable development of business and society – was also seen as a key topic.

Julia Taeschner

Group Sustainability Officer Aareal Bank

„We aim to provide services that are consistent with sustainability standards and our own commitment to acting responsibly to play an active role in influencing sustainable economic and social development, focusing on both the opportunities and risks involved.“

As a bank, we are required to meet governance requirements in particular, over and above taking environmental and social interests into account. To make ourselves fit for the future in this respect, we overhauled our ESG governance structure in 2021, redefining roles and responsibilities at various levels, among other measures.

Mastering and shaping the transformation process

Our aim is to use our products and services to help shape the transformation of the property industry. This is why we attach a great deal of importance to picking up on emerging developments and trends early on and assessing them correctly. After all, this is a must if we want to be able to forecast changing needs and market structures and translate these into innovative products and services that offer our clients real added value.

This is something we are all the better placed to achieve if we remain curious, open and agile, if we show drive and enthusiasm, have lively discussions to identify the best solutions and pair our skills with ambition and genuine passion.

Innovation Management

Evolution of the Bank as an organisation: this is the focus of our Centre of Competence for Innovation. We want to further enhance existing technologies, products and business models, making them even better in the process. Our clients are our most important development partners: more and more often, we work hand-in-hand with them to develop innovative solutions that address the challenges of today.

Foresight Management

In order to ensure that we pick up on the developments and trends that are relevant to us, our innovation activities are focusing on foresight management. We use a systematic and clearly structured process to look out for, and analyse, any signals regarding potential opportunities and threats in the environment in which we operate. As part of the innovation management process, we use a variety of future scenarios to develop new ideas for products and services or to optimise processes.

Download the charts here in PDF format.

Partnerships and initiatives

We rely on various forms of collaboration to develop new ideas and impetus. These include, for example, our co-creation partnership with hubitation, our sponsorship of the special ESG award as part of the FinTech Germany Award, or the Decarbonize Real Estate Challenge. The latter is aimed at start-ups and scale-ups, recognises solutions for reducing carbon emissions in the property industry, and is organised by Aareon’s subsidiary Ampolon.

Start-up Programme

We consider dialogue and discussion with other market participants to be a key element of our ongoing development. This is why we have been running a comprehensive programme of cooperation with FinTechs, PropTechs and other start-ups for years now. We aim to use this programme to understand developments and trends even better, further strengthen our capacity to innovate and ensure the future viability of our own products and processes. We also acquired a stake in PropTech1 Venture, a venture capital fund specialising in European PropTech start-ups, in mid-2019. The sector-specific fund focuses on the property sector and will help us to forge ahead with our strategic agenda and explore relevant property sector ecosystems. We are also making targeted investments in innovative PropTech and ConstructionTech companies of tomorrow.

Download the charts here in PDF format.

ESG@Aareal

Sustainability – and, in particular, making an active contribution to protecting our climate and establishing ESG principles as a central element of the decision-making process – is a key topic of our time. In order to take into account the profound changes of today and tomorrow at an early stage, we launched the Bank-wide ESG@Aareal initiative in the third quarter of 2020. By way of example, our ESG@Aareal activities have involved developing the Aareal Green Finance Frameworks for Aareal Bank's lending and funding activities, setting out an ESG risk management framework and making our financing portfolios more transparent. Both Green Finance Frameworks were evaluated as credible and effective by Sustainalytics, a major ESG rating and research agency.

Download the charts here in PDF format.

Collaboration as part of the PCAF

We also contribute to various standard-setting initiatives to help us forecast market developments, including the PCAF – Partnership for Carbon Accounting Financials. This is an international initiative that aims to set standards for the assessment and disclosure of greenhouse gas emissions financed by loans and investments. We have made a commitment to reporting on the carbon footprint of our property financing portfolio in line with the PCAF standards from 2024 onwards.

New Work

We are convinced that the quality of employees’ work is also influenced by the environment they work in, which is why we are testing new forms of collaboration. We are continuously enhancing our working environments, focusing on pioneering technologies and methods – but also on a new (leadership) culture that is consistent with the demands of New Work. Flexible working hours models, collaborative and hybrid forms of working and digital solutions for knowledge transfer all form part of day-to-day work at Aareal Bank Group.

Learning@Aareal

Our innovative training and continuing professional development approach, Learning@Aareal, aims to do more than simply allow employees to acquire new skills and qualifications. It also promotes our employees’ personal development by offering a targeted range of sessions that dovetail with our corporate culture, among other things. Learning@Aareal is based on personal initiative: based on the motto "Grow your own way!", it is employees themselves who are responsible for deciding which sessions are particularly relevant to their current remit, and when they want to embark on further training. This is part of our aim to reflect the dynamic environment around us, as well as the concept of lifelong learning, which has become considerably more important, in the best possible way.

![[Translate to English:] Icon Downloads.](../fileadmin/_processed_/5/5/csm_aareal_navi-teaser_downloads@2x_50b1197d1d.png)